Healthcare Costs in Retirement

The Cost of Procrastination

April 21, 2022When Should You Take Social Security

April 21, 2022RETIREMENT

READ TIME: 2 MIN

In a 2021 survey, 32% of all workers reported they were either “not too” or “not at all” confident that they would have enough money to pay for their medical expenses in retirement. Regardless of your confidence, however, being aware of potential health care costs during retirement may allow you to understand what you can pay for and what you can’t.1

Health-Care Breakdown

A retired household faces three types of health care expenses.

- The premiums for Medicare Part B (which covers physician and outpatient services) and Part D (which covers drug-related expenses). Typically, Part B and Part D are taken out of a person’s Social Security check before it is mailed, so the premium cost is often overlooked by retirement-minded individuals.

- Copayments related to Medicare-covered services that are not paid by Medicare Supplement Insurance plans (also known as “Medigap”) or other health insurance.

- Costs associated with dental care, eyeglasses, and hearing aids – which are typically not covered by Medicare or other insurance programs.

It All Adds Up

According to a HealthView Services study a 65-year-old healthy couple (male living to age 87; female, age 89), can expect their lifetime health care expenses to add up to around $662,156.2

Should you expect to pay this amount? Possibly. Seeing the results of one study may help you make some critical decisions when creating a strategy for retirement. Without a solid approach, health care expenses may add up quickly and alter your retirement spending.

Prepared for the Future?

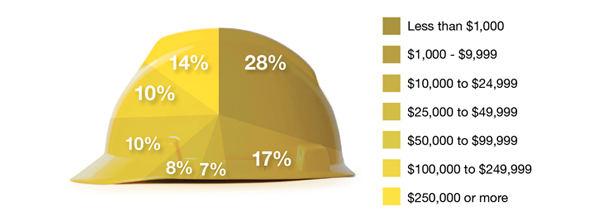

Workers were asked how much they have saved and invested for retirement – excluding their residence and defined benefit plans.

Source Employee Benefit Research Institute, 2020

1. Employee Benefit Research Institute, 2021

2. HealthView Services, 2021

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2022 FMG Suite.