Rebalancing Your Portfolio

Value vs. Growth Investing

April 21, 2022Estimating the Cost of College

April 21, 2022INVESTMENTREAD TIME: 4 MIN

It may sound counterintuitive, but it may be possible to have too much of a good thing. Over time, the performance of different investments can shift a portfolio’s intent – and its risk profile. It’s a phenomenon sometimes referred to as “risk creep,” and it happens when a portfolio has its risk profile shift over time.

When deciding how to allocate investments, many start by taking into account their time horizon, risk tolerance, and specific goals. Next, individual investments are selected that pursue the overall objective. If all the investments selected had the same return, that balance – that allocation – would remain steady for a period of time. But if the investments have varying returns, over time, the portfolio may bear little resemblance to its original allocation.

How Rebalancing Works

Rebalancing is the process of restoring a portfolio to its original risk profile.1

There are two ways to rebalance a portfolio.

The first is to use new money. When adding money to a portfolio, allocate these new funds to those assets or asset classes that have fallen. For example, if bonds have fallen from 40% of a portfolio to 30%, consider purchasing enough bonds to return them to their original 40% allocation. Diversification is an investment principle designed to manage risk. However, diversification does not guarantee against a loss.

The second way of rebalancing is to sell enough of the “winners” to buy more underperforming assets. Ironically, this type of rebalancing actually forces you to buy low and sell high.

Periodically rebalancing your portfolio to match your desired risk tolerance is a sound practice regardless of the market conditions. One approach is to set a specific time each year to schedule an appointment to review your portfolio and determine if adjustments are appropriate.

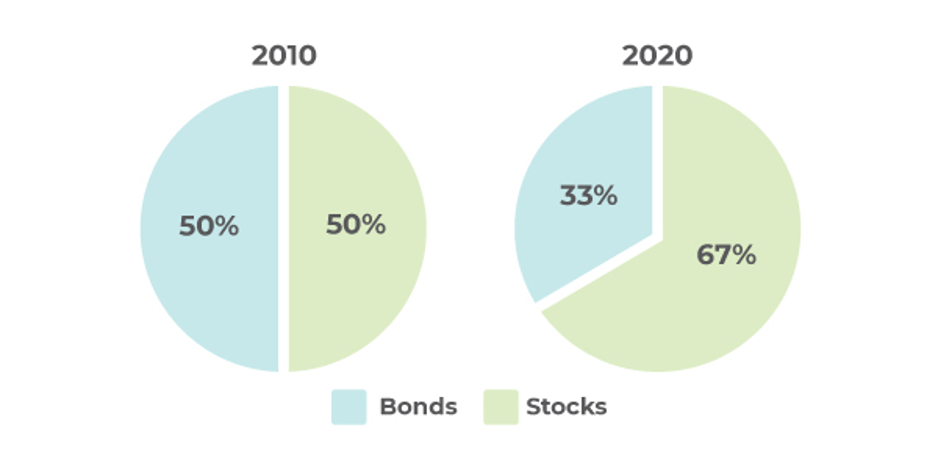

Shifting Allocation

Over time, market conditions can change the risk profile of an investment portfolio. For example, imagine that on January 1, 2010, an investor created a portfolio containing a mix of 50% bonds and 50% stocks. By January 1, 2020, if the portfolio were left untouched, the mix would have changed to 33% bonds and 67% stocks.2

1. Investopedia.com, 2020

2. Stocks are represented by the S&P 500 Composite index (total return), an unmanaged index that is generally considered representative of the U.S. stock market. Bonds are represented by data obtained by the U.S. Department of the Treasury. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. When sold, an investment’s shares may be worth more or less than their original cost. Bonds that are redeemed prior to maturity may be worth more or less than their original stated value. The rate of return on investments will vary over time, particularly for longer-term investments. Investments that offer the potential for high returns also carry a high degree of risk. Actual returns will fluctuate. The types of securities and strategies illustrated may not be suitable for everyone.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2022 FMG Suite.