TIPS for Inflation

Estimating the Cost of College

April 21, 2022Types of Stock Market Analysis

April 21, 2022INVESTMENTREAD TIME: 3 MIN

A Few TIPS

Unlike conventional U.S. Treasury bonds, the principal amount of Treasury Inflation-Protected Securities, or “TIPS” is adjusted when there are changes in the Consumer Price Index (CPI), which measures changes in inflation. When the CPI increases, a TIPS’s principal increases. If the CPI falls, the principal is reduced.

The relationship between TIPS and the CPI can affect the amount of interest you are paid every six months as well as the amount you are paid when your TIPS matures.2

Remember, TIPS pay a fixed rate of interest. Since the fixed rate is applied to the adjusted principal, interest payments can vary from one period to the next. TIPS help eliminate inflation risk to your portfolio as the principal is adjusted semiannually for inflation based on the Consumer Price Index— while providing a real rate of return guaranteed by the U.S. Government.

When TIPS mature, the bondholder will receive either the adjusted principal or the original principal, whichever is greater.2,3

If you are concerned about inflation — and expect short-term interest rates may increase — TIPS are an investment that may be worth considering. A close review of your overall strategy might also reveal other investment choices that may be appropriate in an environment of changing interest rates.

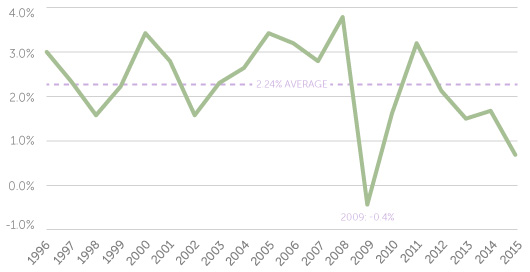

Inflation in Perspective

For the 20-year period ended 2020, the Consumer Price Index bounced around its historical average of 2.12%. In 2021, however, inflation was well above its long-term average.

Source: USInflationCalculator.com, 2021

1. TheBalance.com,2021

2. The interest income from a Treasury Inflation-Protected Security (TIPS) is exempt from state and local taxes. However, according to current tax law, it is subjected to federal income tax. Adjustments in principal are taxed as interest in the year the adjustment occurs even though the principal adjustment is not received by the bondholder until maturity. Individuals should consider their ability to pay the current taxes before investing.

3. Investopedia.com, 2020

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG, LLC, is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2022 FMG Suite.